POPULAR ARTICLES

- e-Invoicing in France 2026: Implementation Timeline, Guidelines & Format

- What is a PDP, OD and PPF in France e-Invoicing?

- All About e-Reporting under France e-Invoicing

- All About Electronic Signature in France e-Invoicing

- France e-Invoicing and e-Reporting FAQs: Rules, Scope & 2026 Requirements

- Factur-X in France: What It Is, How It Works and Steps to Generate

- SIREN and SIRET Numbers: How to Apply and Where to Get Them

- Common e-Invoicing Mistakes in France & How to Avoid Them

- France E-Invoicing Update: Major Simplification Measures Announced

- Top 7 Misconceptions About E-Invoicing in France for 2026

- What is the EN 16931 Electronic Invoicing Standard in France?

- Handling Structured & Unstructured Data in e-Invoicing: XML and PDF/A-3 Explained

- Factur-X vs UBL vs EDIFACT: Which e-Invoicing Format is Best for France

RELATED ARTICLES

- e-Invoicing in France 2026: Implementation Timeline, Guidelines & Format

- What is a PDP, OD and PPF in France e-Invoicing?

- All About e-Reporting under France e-Invoicing

- VAT in France 2025: Rates, Registration, Filing, Payments & Penalties

- France e-Invoicing and e-Reporting FAQs: Rules, Scope & 2026 Requirements

- Credit Note in France: Meaning, Usage, Example & Template

- Factur-X in France: What It Is, How It Works and Steps to Generate

- SIREN and SIRET Numbers: How to Apply and Where to Get Them

- Common e-Invoicing Mistakes in France & How to Avoid Them

- XML vs PDF/A-3 in e-Invoicing: Handling Structured & Unstructured Data

- Top 7 Misconceptions About E-Invoicing in France for 2026

- What is the EN 16931 Electronic Invoicing Standard in France?

- Handling Structured & Unstructured Data in e-Invoicing: XML and PDF/A-3 Explained

B2B e-Invoicing in France: Requirements, Deadlines, and Compliance

France’s B2B e-invoicing reform mandates the exchange of structured electronic invoices for domestic transactions between VAT-registered businesses, routed through approved platforms. It replaces PDFs and paper, introduces parallel e-reporting flows, and applies progressively from September 2026 to all French-established businesses.

Key Takeaways

- All VAT-registered businesses in France must be able to receive structured e-invoices from 1 September 2026.

- Issuance starts in phases: large and mid-sized companies in 2026, SMEs and microbusinesses in 2027.

- Domestic B2B transactions use e-invoicing; B2C and cross-border flows rely on e-reporting, not invoices.

- Invoices must pass through a state-approved platform and be routed using the central directory (Annuaire).

- Only structured formats such as Factur-X, UBL, or CII are compliant; emailed PDFs are not.

What Is B2B e-Invoicing in France?

B2B e-invoicing is the mandatory exchange of invoice data in a structured electronic format for domestic transactions between VAT-registered businesses established in France. It replaces sending invoices as paper, email PDFs, or other unstructured documents.

France’s reform also introduces two related data flows:

- E-reporting of transaction data: mandatory transmission of key transaction information to the tax administration for sales outside domestic B2B e-invoicing, such as B2C and many cross-border flows.

- E-reporting of payment data: required for certain services where VAT is due on payment, so payment status must be reported in addition to transaction data.

Note: The reform concerns B2B. B2G e-invoicing already runs through Chorus Pro and continues under its existing rules.

Scope of e-Invoicing and e-Reporting

This table helps you quickly determine whether e-invoicing, e-reporting, or both apply.

Transaction scenario | e-Invoicing required? | e-Reporting required? | Practical note |

Domestic B2B (both parties established in France, French VAT rules apply) | Yes | No (invoice flow covers reporting) | Includes advance payments relating to those transactions. |

B2G (invoice to the public sector) | Already mandatory via Chorus Pro | No | Separate channel from B2B onboarding. |

B2C (sales to consumers) | No | Yes | Transaction data is reported instead of an e-invoice exchange. |

Exports, imports, and many cross-border transactions | No | Yes (when in scope) | Reporting covers flows that do not have a domestic e-invoice. |

Services where VAT is due on payment (VAT on collection) | Depends | Often yes | Payment data must be reported on the required frequency. |

Implementation Timeline and Deadlines (2026 to 2027)

The e-invoicing mandate is phased by company size, with a universal receive milestone first, followed by phased issue obligations. Company size classification is tied to thresholds in French law and is relevant for determining which date applies.

The following table summarizes the operational deadlines most businesses plan around.

Company Category | Definition | Must be able to receive | Must issue (and e-report) |

Large enterprises | Typically 5,000+ employees or very high turnover thresholds (per French definitions). | 1 Sep 2026 | 1 Sep 2026 |

ETI (intermediate) | Roughly between SME and large (per French definitions). | 1 Sep 2026 | 1 Sep 2026 |

SMEs (PME) | Under SME thresholds (per French definitions). | 1 Sep 2026 | 1 Sep 2027 |

Micro-enterprises | Very small entities (per French definitions). | 1 Sep 2026 | 1 Sep 2027 |

Why France is Adopting B2B e-Invoicing

These reform drivers explain why the changes go beyond invoice format and reach the full invoicing chain.

- Fight VAT fraud more effectively through near real-time visibility of invoice and transaction data.

- Improve business competitiveness by reducing manual processing and shortening payment cycles.

- Simplify VAT compliance over time, including enabling pre-filled VAT returns.

- Improve economic activity monitoring with more timely and standardized data.

Core Compliance Requirements for B2B e-Invoicing in France

The key to compliance is combining the right platform, the right data format, and operational controls that prevent rejected invoices.

1) Use a state-approved platform for exchange and reporting

From September 2026, companies submit invoices via a government-approved platform, either directly or through a compliant solution that relies on an approved platform (PA or PDP officially).

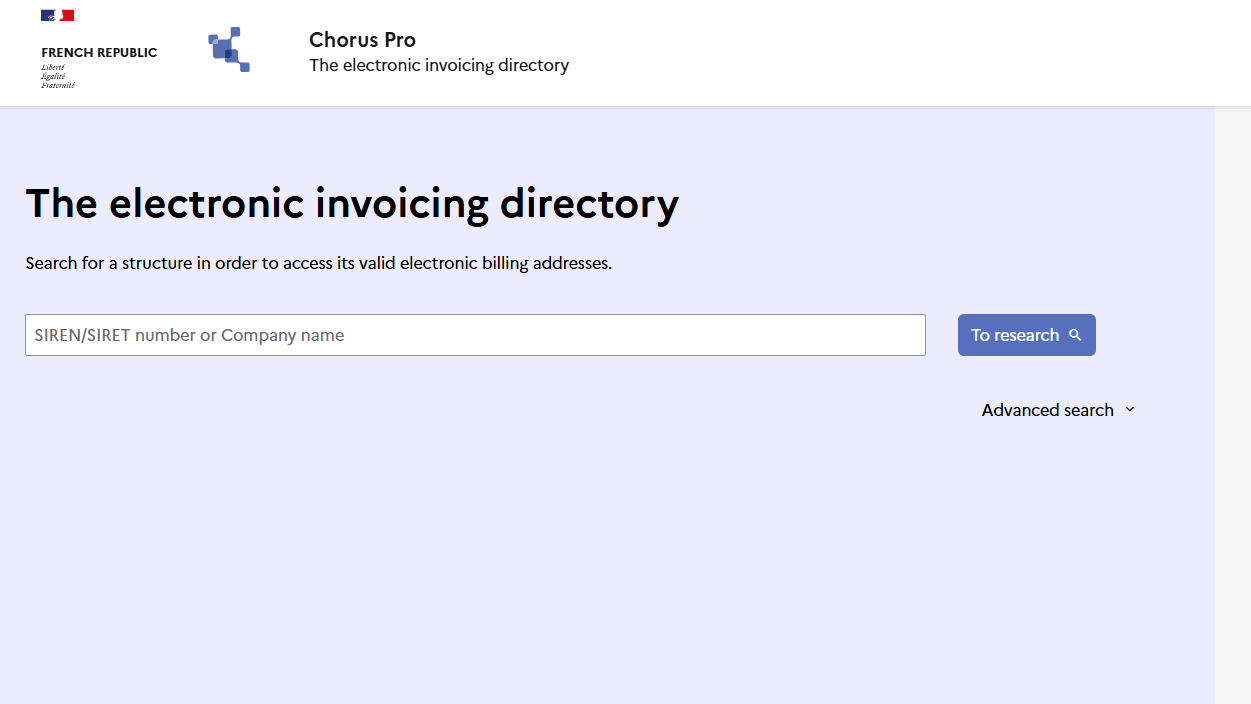

A central directory called the Annuaire supports routing by identifying the recipient’s declared platform and invoicing address.

2) Issue invoices in a supported structured format

To be interoperable, invoices must be structured in a format supported by your platform and compatible with the ecosystem’s minimum common formats.

3) Add new mandatory invoice data and keep master data clean

The fastest way to reduce rejections is to standardize invoice data and ensure identifiers match what is registered in the directory.

Mandatory element to manage

- Customer SIREN number

- Delivery address (when different from billing)

- Transaction category (goods, services, or both)

- VAT on debits indicator (when the supplier opted in)

- Supplier and buyer identifiers (including SIRET where applicable)

- Invoice number, issue date, and totals

4) Secure, preserve, and archive invoices

Invoices must be retained for at least six years under French tax law. Secure archiving requires preserving integrity, authenticity, and readability throughout the retention period, using tamper-proof storage, and traceable access logs.

PPF and PA in France’s e-Invoicing Architecture

France’s B2B e-invoicing model is built on a dual-layer framework that separates public regulatory oversight from private operational invoice exchange.

- PPF (Portail Public de Facturation): The PPF is the state-operated public invoicing portal managed by the French tax administration. It provides the Annuaire for recipient identification, supports centralized monitoring, and enables the transmission of e-reporting and payment data to the authorities. The PPF ensures ecosystem-wide interoperability and regulatory control but does not function as a business invoicing tool.

- PA (Plateforme Agréée): A PA, formerly referred to as a PDP (Plateforme de Dématérialisation Partenaire), is a state-approved private platform authorized to issue, receive, validate, and route structured e-invoices. PAs integrate with ERP and billing systems, apply technical and business validations, manage invoice life-cycle statuses, and support e-reporting where applicable.

Step-by-Step Process: How B2B e-Invoicing Works in France

This end-to-end flow shows what must happen from invoice creation to delivery, reporting, and audit-ready archiving.

Step 1: Classify the transaction

Classify each sale using customer type, location, and VAT rules, then route it to either the e-invoice flow (domestic B2B) or the e-reporting flow (outside domestic B2B).

Step 2: Create a structured invoice in your ERP or billing system

Generate the invoice in a supported structured format and ensure mandatory legal and VAT fields are populated, including the new mandatory particulars that apply at go-live.

Step 3: Validate the invoice before submission

Run pre-checks for mandatory fields, arithmetic, VAT logic, and identifiers, including customer SIREN or SIRET and delivery address rules.

Step 4: Submit the invoice to your approved platform

Send the invoice to the platform for format checks, business-rule validation, and preparation for routing to the recipient’s platform.

Step 5: Route using the Annuaire

The platform queries the Annuaire to find the recipient’s declared platform and invoicing address, then routes the invoice accordingly.

Step 6: Receive acknowledgements and life-cycle statuses

Platforms exchange standardized acknowledgements and life-cycle statuses so both parties can track delivery, processing, and outcomes inside their AR and AP workflows.

Step 7: Buyer processing and dispute handling

If the buyer rejects or refuses the invoice, treat it as an exception workflow: correct data, issue a replacement invoice or credit note where required, resend, and retain the audit trail.

Step 8: Transmit e-reporting and payment data when required

For sales outside domestic B2B, the platform transmits the required transaction data to the administration. For services where VAT is due on payment, it also transmits payment information on the required schedule.

Step 9: Archive and retain audit evidence

Store the structured invoice, any human-readable representation if used, and all acknowledgements and status logs in an audit-ready archive.

Routing and Data Flow in France’s e-Invoicing Ecosystem

Correct routing ensures every invoice reaches the buyer through the PA they have declared in the Annuaire. If routing fails, invoices may be rejected or never delivered, and required tax data may not be reported. This routing logic allows businesses to use different providers while ensuring interoperability, traceability, and consistent tax reporting across the entire e-invoicing framework.

The table below explains, in simple terms, how invoices and reporting data move in each scenario.

Business situation | How the invoice is exchanged | What is sent to the tax authority |

Sender and buyer use the same PA (approved platform) | A single PA handles invoice submission, delivery to the buyer, and status updates | The PA automatically transmits the required invoice data to the tax authority as part of the process. |

Sender and buyer use different PAs | The sender’s PA identifies the buyer’s PA via the Annuaire and routes the invoice to it | Invoice data and any required reporting data are transmitted through the respective PAs to the tax authority. |

Transaction is outside domestic B2B scope, such as B2C or many cross-border sales | No e-invoice is exchanged between parties | Only transaction data, and payment data when required, is reported to the tax authority via the PA. |

How to Prepare for France’s e-Invoicing Rollout

Use this checklist to turn the mandate into an operational process that does not break at go-live.

Readiness and implementation checklist

These actions reduce integration delays and rejection rates.

- Assign an owner for e-invoicing, with clear AR, AP, IT, and tax responsibilities.

- Choose your receiving setup early, since all businesses must be able to receive from 1 September 2026.

- Clean master data: validate SIREN or SIRET, VAT IDs, customer and supplier addresses, and payment terms.

- Map transaction types to e-invoicing versus e-reporting, including services subject to VAT on payment.

- Upgrade ERP, billing, and AP tools to produce and ingest structured formats, and to process status messages.

- Test routing using the Annuaire, and run end-to-end tests with key customers and suppliers.

- Define exception workflows for rejected or refused invoices, credit notes, and dispute handling.

- Set up archiving, audit logs, and monitoring dashboards before the first mandatory transmission.

Public Portal vs PA

It is important to determine the operating approach based on invoice volume, integration needs, and process maturity.

Decision Factor | Public Portal Approach (manual) | Approved Platform (PA) Approach (integrated) |

Invoice volume | Best suited for very low volume issuance and reception. | Best suited for recurring volume and automation requirements. |

ERP integration | Limited integration, more manual work. | Designed for ERP and workflow integration and format conversion. |

Operational monitoring | Requires disciplined portal checks and manual exception handling. | Enables automated alerts, routing, and exception workflows. |

Compliance scalability | Compliance is possible but process risk rises with volume. | Scales better for multi-entity and multi-system environments. |

Selecting the right PA

Its important to partner with the right platform for e-invoicing compliance. Here are a few thing you could consider

- Invoice volume and automation: API support, batch processing, and automated validation at scale.

- ERP and workflow integration: Connectors for your ERP, AP, and AR tools, plus status message handling.

- Format support: Native support for the structured formats you can produce and consume.

- Exception management: Clear rejection reasons, dispute workflows, and monitoring dashboards.

- Multi-platform strategy: Ability to use one platform for issuing and another for receiving if needed.

How to avoid failures and rejections

This table highlights the most common issues that block delivery and how to prevent them.

Common failure point | How to prevent it |

Recipient not found or wrong routing address | Keep customer identifiers and invoicing address validated against the Annuaire. |

Missing new mandatory particulars | Update invoice templates to capture customer SIREN, delivery address logic, and transaction category. |

VAT calculation or totals mismatch | Add automated arithmetic and VAT rule checks before sending. |

Format validation error | Use platform validation in pre-production and lock to a supported format profile. |

Unresolved rejected or refused statuses | Define a timed exception workflow and track resolution until closed. |

What Are the Penalties for Non-Compliance?

France's framework includes financial penalties and practical commercial consequences that can disrupt cash flow. Penalties referenced in implementation guidance include a per-invoice fine for failing to issue electronically when required and a per-report fine for missing e-reporting obligations, both with annual caps.

- Per-invoice penalty: €15 per invoice, capped at €15,000 per year.

- Per e-reporting penalty: €250 per missing report, capped at €45,000 per year.

- Commercial risk: Buyers may reject non-compliant invoices, delaying payment and triggering contract disputes.

- Tax risk: Poor invoice form and missing compliant issuance can create VAT deduction friction until corrected documentation exists.

Benefits of e-Invoicing for Businesses

These benefits come from treating e-invoicing as a process upgrade rather than a last-minute compliance change.

- Faster invoice processing, fewer manual entry errors, and improved straight-through posting.

- Better dispute visibility through standardized status messages and clearer exception ownership.

- More reliable audit evidence, with consistent logs of creation, delivery, and acceptance.

- Improved cashflow through fewer delivery failures and better payment follow-up.

- A scalable foundation for future automation, including VAT reporting simplification.

Conclusion

France’s B2B e-invoicing reform is less about replacing PDFs and more about making invoice data usable across finance, tax, and operations. Start with clean identifiers and transaction mappings, then choose a platform you can operate reliably, test early, and treat exceptions as a tracked workflow, not an afterthought.

Government Resources and Official Portals

Use these official references to validate scope, deadlines, directory lookups, and platform registration.

Resource | What it covers |

Service-Public: publication of the list of registered approved platforms | Official rollout timetable, scope highlights, new mandatory particulars, and links to the platform list and legal texts. |

Reform overview, calendar PDFs, and access to the official list of approved platforms. | |

Definitions of e-invoicing, e-reporting, and payment reporting. | |

Directory search to identify recipient routing details (platform and invoicing address). | |

| DGFiP external specifications for B2B e-invoicing and e-reporting | Technical and standards references for platform exchanges and reporting services. |