POPULAR ARTICLES

- e-Invoicing in Malaysia: Guidelines, Requirements, Timeline & Exemptions (2025)

- Self-Billed e-Invoice Malaysia: Requirements, Process & Examples

- Malaysia e-Invoicing FAQs: Everything You Need to Know (2025 Updated)

- e-Invoice Implementation Date Malaysia 2025: LHDN Phases & Relaxation Period

- List of LHDN Fines and Penalties 2025

- Consolidated e-Invoicing in Malaysia: Issuance, Details and Special Scenarios

- e-Invoice Exemptions in Malaysia and Relaxation Period [2025]

- e-Invoicing Deadline Extended: IRBM Offers Six-Month Grace Period

- Important Data Fields Required for an E-Invoice in Malaysia

- e-Invoicing for Employee Perquisites and Benefits in Malaysia

- Myinvois Portal User Guide: How to Generate e-Invoice, Features & FAQs

RELATED ARTICLES

- TIN Number in Malaysia 2025: How to Check, Format & Examples

- SST Malaysia 2025: Registration, Meaning, Exemption List & Rates

- MSIC Code Malaysia: Complete List, Meaning & How to Search

- VAT Tax Refund Malaysia 2025: Step-by-step Guide, Documents for Reclaiming SST

- Stamp Duty in Malaysia: Rates, Exemptions & Penalties

- Withholding Tax in Malaysia: Meaning, Rates, Examples & How It Works

- Self-Billed e-Invoice Malaysia: Requirements, Process & Examples

- What is Credit Note? Meaning, Sample, Template

- Malaysia e-Invoicing FAQs: Everything You Need to Know (2025 Updated)

- Tax Clearance in Malaysia: A Comprehensive Guide in 2025

HS Code Malaysia: Meaning, Lookup, & Complete List [2025]

Malaysia uses the Harmonised System (HS) Code as its internationally harmonised numerical goods classification system for traded goods. It is placed at the forefront of import and export compliance, enabling the proper calculation of duties, smooth customs clearance, and compliance with international trade procedures.

Operated by the Royal Malaysian Customs Department (Kastam), the HS Code system requires businesses to accurately classify, quote a specific code, or browse the entire customs list, to avoid fines, delivery delay, or even rejection. Accurate knowledge of the Kastam HS Code procedure is crucial in generating accurate trading documents as well as successful cross-border transactions.

What is HS Code?

The Harmonised System (HS) Code is a globally recognised numerical system, developed by the World Customs Organisation (WCO), for categorising goods in global trade. It helps customs administrations globally to select products, ascertain proper duty rates, and levy trade regulations.

Malaysia has the Royal Malaysian Customs Department (Kastam), which implements the HS Code system, and its use is obligatory in export and import activities. The HS Code functions as a product identifier in international trade since it gives a specific and descriptive product description to allow customs officers to levy the correct tariff rates. Misclassification of goods could result in delayed processing, charging the wrong duty, or rejection of goods at the border.

HS Code List Malaysia

If you’re shipping goods to or from Malaysia, knowing the right HS code is crucial for smooth customs clearance and accurate duties. Below is a quick reference for some commonly used HS codes in the country:

Product | HS Code | Description |

T-Shirts | 6109.10.00 | Cotton T-shirts |

Mobile Phones | 8517.12.00 | Smartphones |

Coffee Beans | 0901.11.00 | Not roasted, not decaffeinated |

Laptops | 8471.30.10 | Portable computers |

Beauty Products | 3304.99.00 | Makeup & skincare |

Instant Noodles | 1902.30.00 | Pasta prepared with seasonings |

You can get the full official list from the Malaysian Customs Tariff Classification (HS Explorer).

HS Code for Import & Exports in Malaysia

Malaysia’s import and export operations rely on specific HS codes to classify goods accurately for customs clearance, tariff application, and trade compliance. Below are examples of commonly used HS codes for both imports and exports in Malaysia.

HS Codes for Import

HS Code | Description |

4403 | Wood in the rough, whether or not stripped of bark or sapwood, or roughly squared |

44034910 | Teak wood in rough |

44034100 | Dark Red Meranti, Light Red Meranti and Merant Bakau |

44039929 | Other |

8542 | Electronic integrated circuits |

85423100 | Processors and controllers, whether or not combined with memories, converters, logic circuits, amplifiers, clock and timing circuits, or other circuits |

8529 | Parts suitable for use solely or principally with the apparatus of headings 8525 to 8528 |

85299090 | Other |

HS Codes for Export

HS Code | Description |

2103 | Sauces and preparations therefor, mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard |

21039090 | Other |

3004 | Medicaments (excluding goods of heading 3002, 3005 or 3006) consisting of mixed or unmixed products for therapeutic or prophylactic uses |

30049099 | Other |

8443 | Printing machinery used for printing by means of plates, cylinders and other printing components of heading 8442; other |

84433290 | Other |

8508 | Vacuum cleaners |

85081100 | Of a power not exceeding 1,500 W and having a dust bag or other receptacle capacity not exceeding 20 l |

4907 | Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognised face value |

49070020 | Bank notes |

Breakdown of Malaysia’s 8-Digit HS Code Structure:

HS Code Example: HS Code 09012110 denotes roasted coffee, not decaffeinated, under Malaysia’s customs classification.

- First 2 digits – HS Chapter: Defines the broad category of goods (e.g., 09 represents coffee, tea, mate, and spices).

- Next 2 digits – HS Heading: Specifies a more distinct product group within the chapter (e.g., 0901 for coffee).

- Next 2 digits – HS Subheading: Provides a further detailed classification based on characteristics such as product type or processing stage (e.g., 090121 for roasted coffee).

- Final 2 digits – ASEAN Harmonised Tariff Nomenclature (AHTN) code: Adds Malaysia’s regional classification for greater specificity.

Accurate customs HS code determination is essential for correct tax computation, adherence to HS code Kastam requirements, and the avoidance of clearance disruptions.

How does HS code work?

The HS Code functions as a standardised global system for the categorisation of goods in international trade. It enables customs authorities to identify products, assign the applicable duties, and compile reliable trade statistics.

Core Functions of HS Codes:

- Harmonised format: The initial six digits of an HS Code are harmonised globally, whereas additional figures are used by each country to classify at a more specific level.

- Product classification: Codes are allocated according to a product's nature, material content, and functional purpose.

- Clearance of customs: HS Codes are indicated on shipping and customs documents for governments to use to charge tariffs, taxes, and regulatory controls.

- Trade data management: Governments use HS Code records for tracking trade flows, understanding economic trends, and policy formulation.

- Global consistency: Global acceptability of the system allows for uniform application of product classification across national boundaries.

How to Check HS Code Online in Malaysia (Via JKDM Portal)

To check the HS code for a product, businesses and individuals can use the Jabatan Kastam Diraja Malaysia (JKDM) HS Explorer. This portal helps in identify the correct HS code, check tariff rates, and verify import or export restrictions. Here is the step-by-step process to find the HS code in Malaysia:

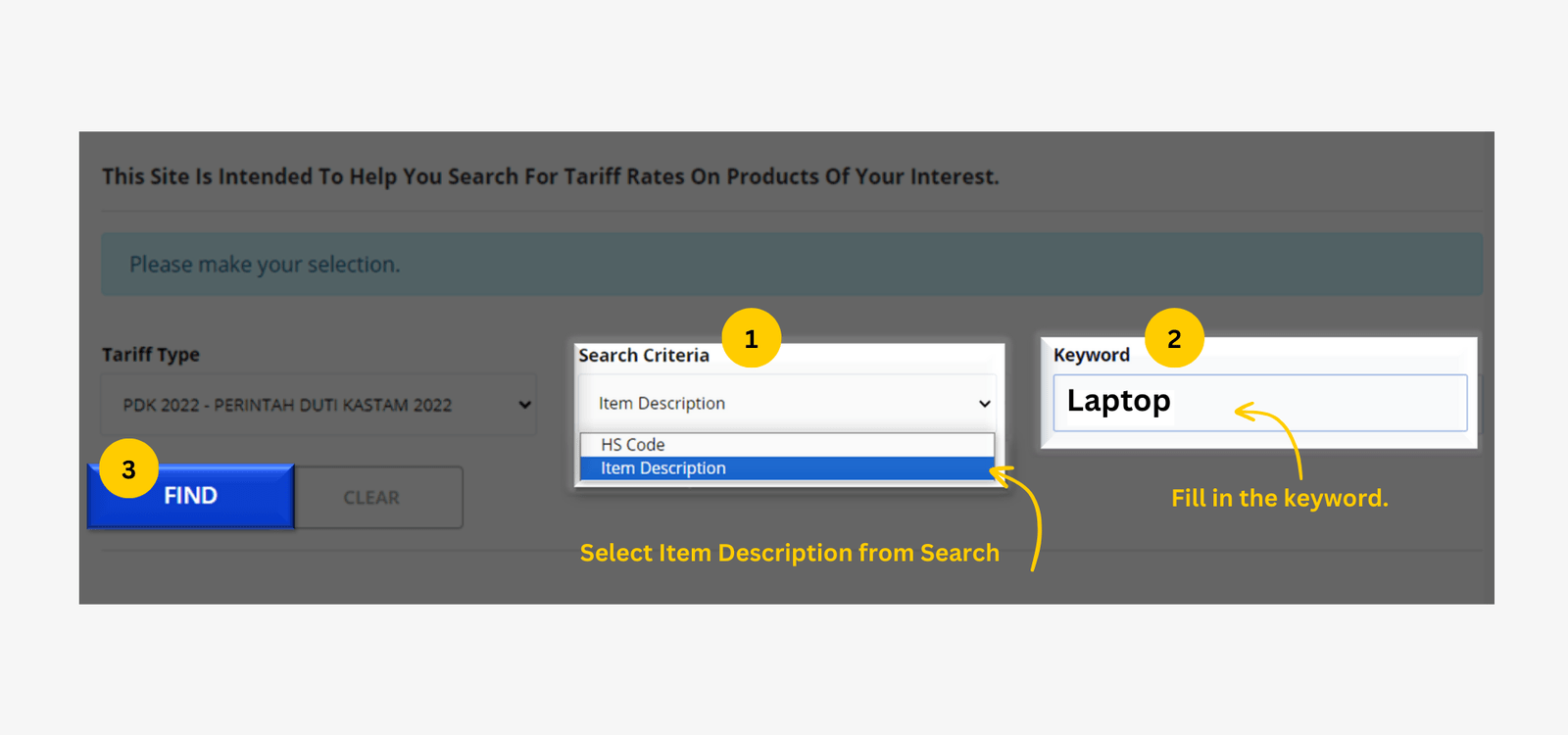

Find Product HS Code

- Step 1: Start by visiting the JKDM HS Code Explorer website.

- Step 2: Select the search criteria as Item Description while keeping the tariff type as PDK 2022.

- Step 3: Enter the product name in the keyword field, such as “honey” or “laptop.”

- Step 4: Select the code that most accurately reflects your product’s specifications (to ensure proper classification).

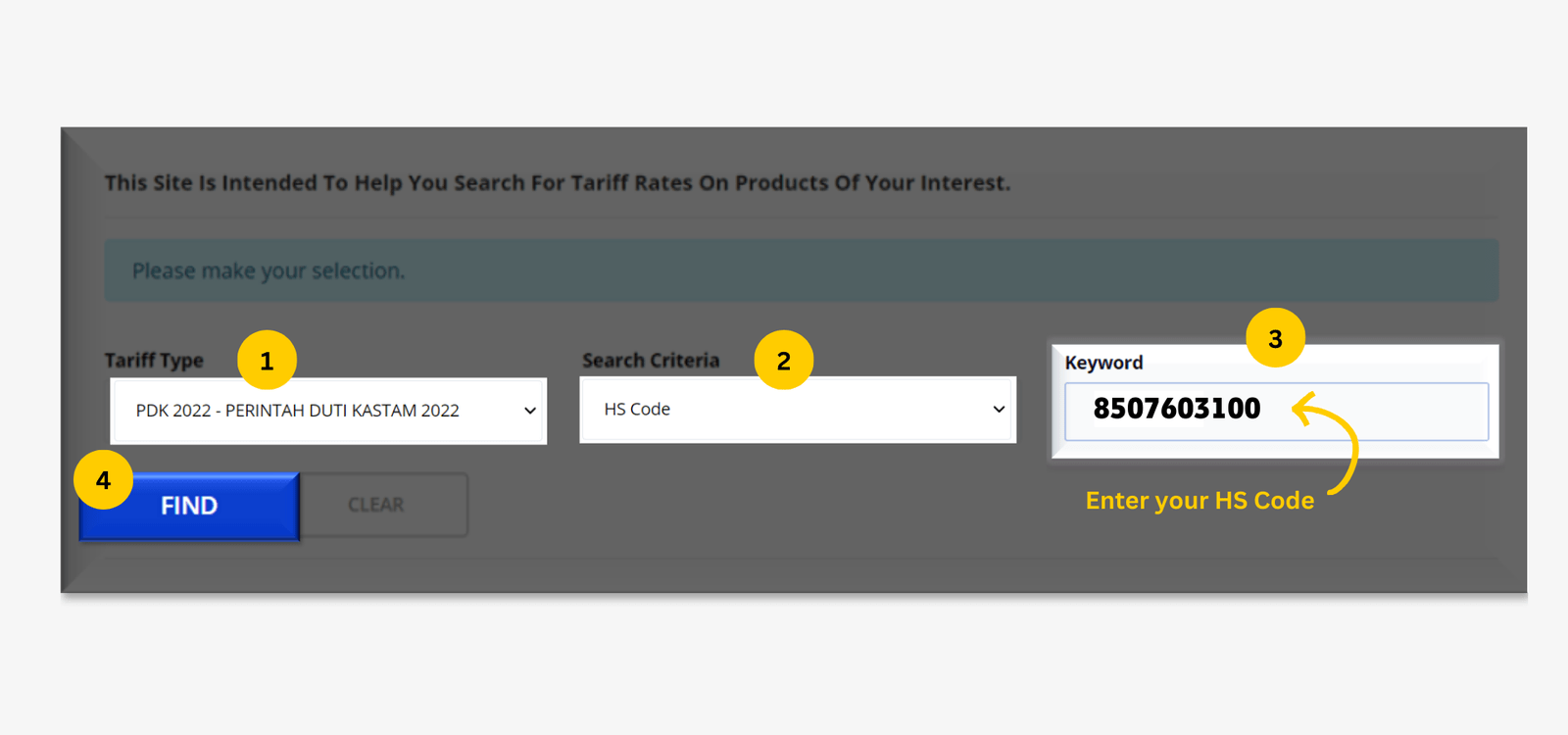

How to verify your HS Code is correct?

- Step 1: Logon to the JKDM HS Code Explorer website.

- Step 2: Keep the default tariff type as PDK 2022 – Perintah Duti Kastam 2022.

- Step 3: Search criteria as HS Code.

- Step 4: Enter the HS code number in the keyword field.

The system will display a detailed product description, which should be reviewed to confirm it matches the exact characteristics of the item.

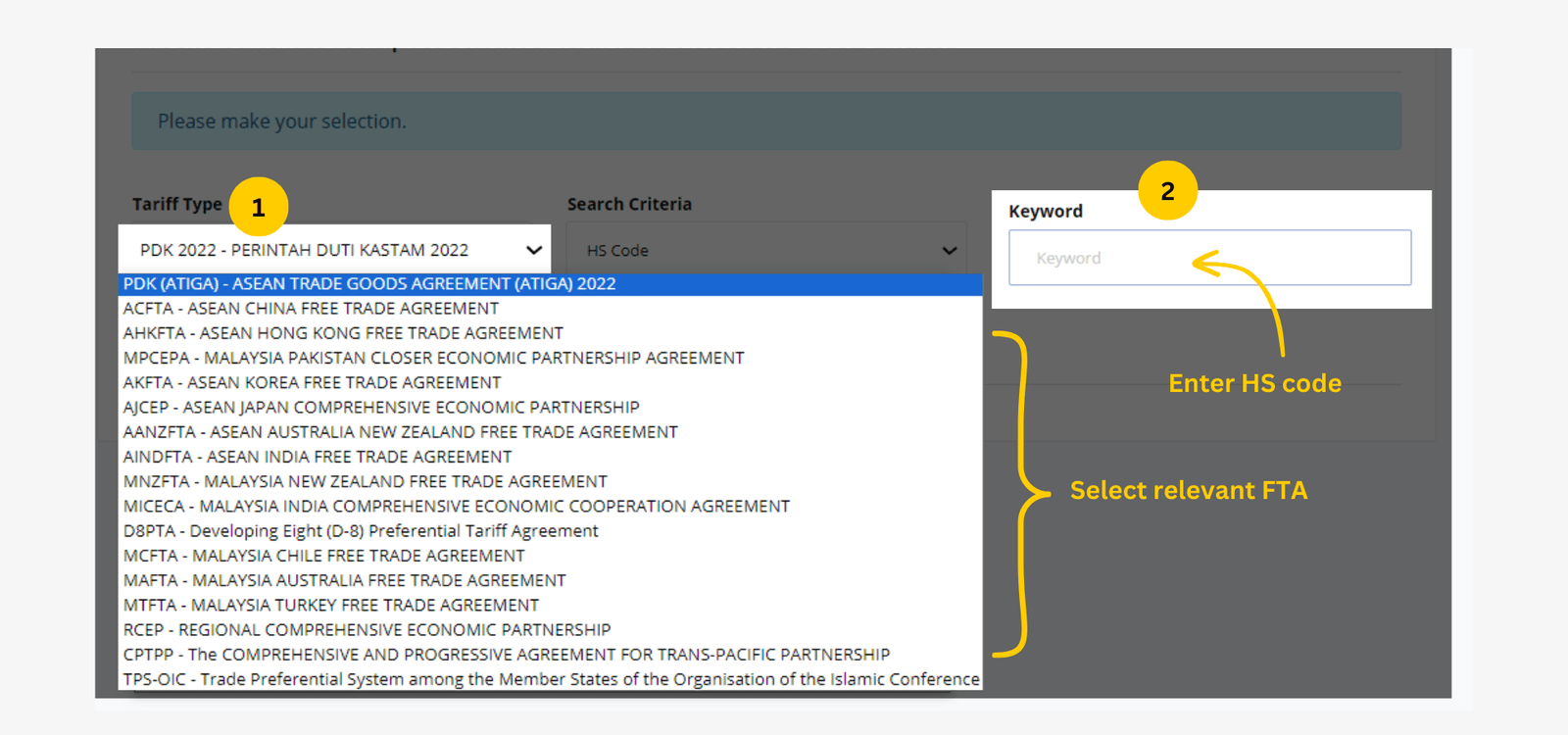

How to Check Applied Tariff on Your HS Code

Malaysia applies a default tariff based on PDK 2022 but also offers preferential rates under 17 Free Trade Agreements (FTA). To check if a special tariff applies:

- Change the tariff type to the relevant FTA.

- Enter the product’s HS code.

The system will show the applicable duty rate; for example, under ATIGA, certain goods may qualify for 0% import duty.

Why HS Codes Matter in Malaysia

HS codes are not just numbers; they determine how goods are classified, taxed, and cleared through customs in Malaysia. Using the right HS code ensures smooth trade operations and avoids costly mistakes.

Key reasons HS codes matter:

- Accurate customs clearance: Prevents shipment delays and rejections.

- Correct duty and tax calculation: Ensures you pay only what’s required.

- Compliance with Malaysian trade laws: Avoids penalties and fines.

- Trade data tracking: Helps monitor import/export trends for business insights.

- Facilitates international trade agreements: Ensures eligibility for preferential tariffs under FTAs.

What happens if you use the wrong HS code?

Using the wrong HS Code in Malaysia can cause more than just delays; it can lead to costly mistakes.

Consequence | Impact |

Customs Delays | Shipments may be held for verification, slowing delivery times. |

Fines & Penalties | Authorities can impose monetary fines for misclassification. |

Incorrect Duties & Taxes | You may overpay or underpay, causing compliance issues. |

Reputational Damage | Frequent errors can affect your credibility with partners and customs. |

Seizure of Goods | In severe cases, goods may be confiscated or rejected. |

Conclusion

In Malaysia, HS codes are an important asset to ensure proper product identification in international transactions, correct duties, taxes and compliance with laws. They smooth the operations of import/export, avoid costly hang-ups and help protect against legal penalties.

Businesses can find the correct HS codes through the government of Malaysia's customs database, trade portals, or licensed customs brokers. Staying on top of the current HS code list, the correct assignment is the most reliable method to ensure hassle-free and compliant cross-border delivery of goods.

Suggested Read:

- e-Invoicing in Malaysia: Complete Guide

- e-Invoicing FAQs in Malaysia

- Transaction Types of e-Invoicing in Malaysia

- e-Invoice Model in Malaysia

- Important Terms in Malaysia e-Invoicing

- Reasons for Rejection and Cancellation of e-Invoice in Malaysia

- e-Invoice Malaysia Penalties

- Self-Billed e-Invoice in Malaysia