RELATED ARTICLES

- E-Invoicing in Saudi Arabia

- ZATCA e-Invoicing Phase 2: Applicability, Requirements, Rules and Regulations in Saudi Arabia

- ZATCA Announced Wave 2 Under Phase 2 of e-Invoicing in Saudi Arabia

- ZATCA Announced Wave 3 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 4 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 5 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 6 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 1 Under Phase 2 of e-Invoicing in Saudi Arabia

- How to Validate ZATCA e-Invoice Using QR Code?

- FAQs on Phase 2 of KSA e-Invoicing

- ZATCA Announced Wave 7 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 8 Under Phase 2 of Saudi Arabia e-Invoicing

- KSA VAT Number Verification: How to Verify a VAT Number in Saudi Arabia?

- Impact of ZATCA e-Invoicing on Saudi Arabia Businesses

- ZATCA Announced Wave 9 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 10 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 11 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 12 Under Phase 2 of Saudi Arabia e-Invoicing

ZATCA Notices for Non-Compliance with e-Invoicing Regulations

The Zakat, Tax and Customs Authority (ZATCA) implemented phase 1 of e-invoicing in Saudi Arabia on 4th December 2021. Further, it planned to implement phase 2 in waves from 1st January 2023 and announced eight waves.

Till now, only large enterprises integrated with the Fatoora portal and started generating phase 2 e-invoices. During the initial stage of e-invoicing implementation, ZATCA was continuously coordinating with taxpayers and informing them whenever there were a huge number of errors in the invoice XML files.

However, the authority started issuing notices (without penalty) to businesses not generating e-invoices per the ZATCA e-invoice and Value Added Tax (VAT) regulations.

Sample notices issued by ZATCA to businesses

We've listed down different types of ZATCA notices received by businesses for non-compliances.

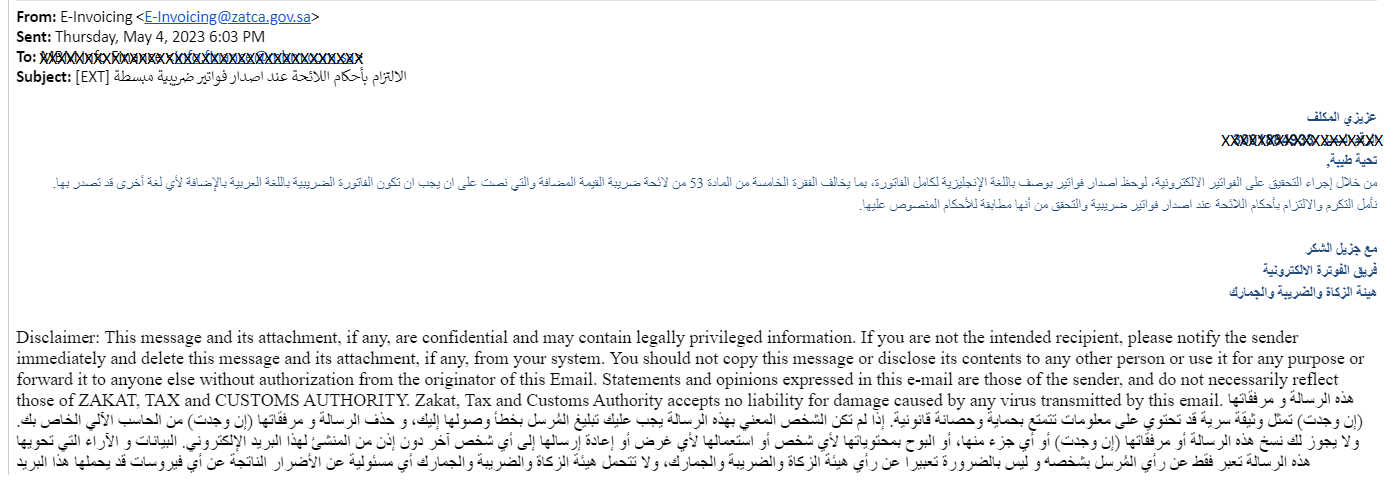

Sample notice 1:

Here's a notice received by a business for not reporting e-invoices data in Arabic language:

Here’s a translated version of the ZATCA notice:

Through investigating electronic invoices, we observed that invoices were issued with a description in English for the entire invoice, in violation of the fifth paragraph of Article 53 of the Value Added Tax Regulations, which stipulates that the tax invoice must be in Arabic in addition to any other language in which it may be issued.

We hope you will kindly adhere to the provisions of the regulations when issuing tax invoices and verify that they comply with the stipulated provisions.

Sample notice 2:

Here's a notice received by business for making wrong VAT disclosure:

Actions to be taken by businesses

Currently, ZATCA is not imposing any penalties for non-compliance with e-invoicing regulations. Previously, the authority announced they would not impose penalties until 31st December 2023. The intention is to increase e-invoicing adoption and provide ample time for businesses to integrate with the Fatoora portal correctly as per the regulations.

However, initiating the notices (without penalty) can be a starting point for imposing penalties. Hence, businesses that have already integrated with Fatoora must check whether the e-invoices are generated per the ZATCA regulations to avoid notices and penalties.

The businesses which fall under wave 4 or further shall be more careful while integrating their systems with ZATCA. Also, they should do more test runs to check different use cases to generate phase 2 complaint e-invoices and eventually avoid paying penalties.