RELATED ARTICLES

- E-Invoicing in Saudi Arabia

- ZATCA e-Invoicing Phase 2: Applicability, Requirements, Rules and Regulations in Saudi Arabia

- ZATCA Announced Wave 2 Under Phase 2 of e-Invoicing in Saudi Arabia

- ZATCA Announced Wave 3 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 4 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 5 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 6 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 1 Under Phase 2 of e-Invoicing in Saudi Arabia

- How to Validate ZATCA e-Invoice Using QR Code?

- FAQs on Phase 2 of KSA e-Invoicing

- ZATCA Announced Wave 7 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 8 Under Phase 2 of Saudi Arabia e-Invoicing

- KSA VAT Number Verification: How to Verify a VAT Number in Saudi Arabia?

- Impact of ZATCA e-Invoicing on Saudi Arabia Businesses

- ZATCA Announced Wave 9 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 10 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 11 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 12 Under Phase 2 of Saudi Arabia e-Invoicing

How to Integrate Oracle Fusion with ZATCA?

Zakat, Tax and Customs Authority (ZATCA), the tax implementation authority, planned to implement e-invoicing in the Kingdom of Saudi Arabia (KSA) in phases. Accordingly, it implemented phase 1 w.e.f 4th December 2021 and began phase 2 in waves w.e.f 1st January 2023. Further, ZATCA clarified that it categorises the businesses for phase 2 and notifies them six months before their wave.

Accordingly, it announced the following waves:

- Wave 1 under phase 2: Taxpayers with more than 3 billion SAR turnover in 2021 fall under wave one w.e.f 1st January 2023.

- Wave 2 under phase 2: Businesses registered under Value Added Tax (VAT) in Saudi having SAR 500 million and less than SAR 3 billion in 2021 fall under wave two from 1st July 2023.

- Wave 3 under phase 2: Saudi taxpayers having more than SAR 250 million and less than SAR 500 million turnover in 2021 or 2022 fall under Wave 3 from 1st October 2023.

- Wave 4 under phase 2: Taxpayers in Saudi having a turnover of more than SAR 150 million and less than SAR 250 million in 2021 or 2022 fall under wave four w.e.f 1st November 2023.

- Wave 5 under phase 2: VAT-registered businesses with more than SAR 100 million and less than SAR 150 million turnover in 2021 or 2022 must integrate with the Fatoora portal starting 1st December 2023.

- Wave 6 under phase 2: Taxpayers in Saudi with more than SAR 70 million and less than SAR 100 million turnover in 2021 or 2022 shall integrate with ZATCA’s Fatoora portal starting 1st January 2024.

Hence, the applicable businesses shall integrate their ERP/POS with ZATCA within specified timelines and generate phase 2 compliant invoices.

Role of middleware in ZATCA integration

Middleware is software to connect the operating system and applications, particularly within a network. In Saudi Arabia’s e-invoicing perspective, the middleware has APIs to integrate with ZATCA to perform various e-invoicing.

The e-invoicing middleware comes with the following features:

- Simple integration with any ERP/ POS through Plug-n-play APIs

- Integration without significant changes to ERP/POS

- Single API to support all e-invoicing activities

- Connect seamlessly with ZATCA

- Quick generation of e-invoices

- Invoice generation in notified PDF/ A3 with XML

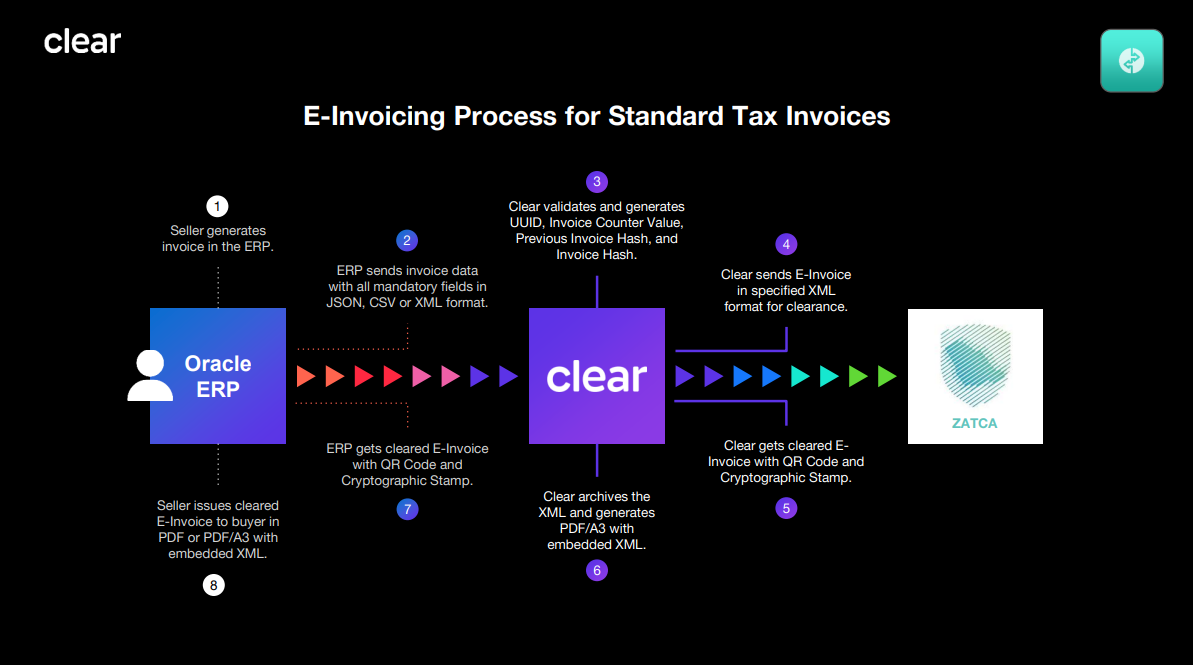

e-Invoice generation workflow in Oracle Fusion

How can ClearTax help you easily integrate Oracle Fusion with ZATCA?

ClearTax is middleware connecting the ERP/POS with the ZATCA’s Fatoora portal. We ensure 100% e-invoicing compliance and automatically register hundreds of ERP/POS within a single click to receive cryptographic stamps for each device.

It comes with below features:

- More than 150 smart data validations ensure invoice data is as per ZATCA regulations and are error-free.

- Generation of key mandatory fields such as UUID, QR Code, invoice hash and invoice counter value.

- Converts the data into ZATCA notified UBL 2.1 XML invoice format

- Automatically send invoice data to the ClearTax cloud platform for conversion to ZATCA e-invoice.

- Includes phase 2 QR code & certified XML in the existing invoice to generate the final PDF A/3 invoice.

- Archival of e-invoices on SLA-based cloud servers for up to six years.